A Biased View of Amur Capital Management Corporation

Table of ContentsThe Best Guide To Amur Capital Management CorporationFacts About Amur Capital Management Corporation UncoveredThe Basic Principles Of Amur Capital Management Corporation A Biased View of Amur Capital Management CorporationAll about Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals Explained

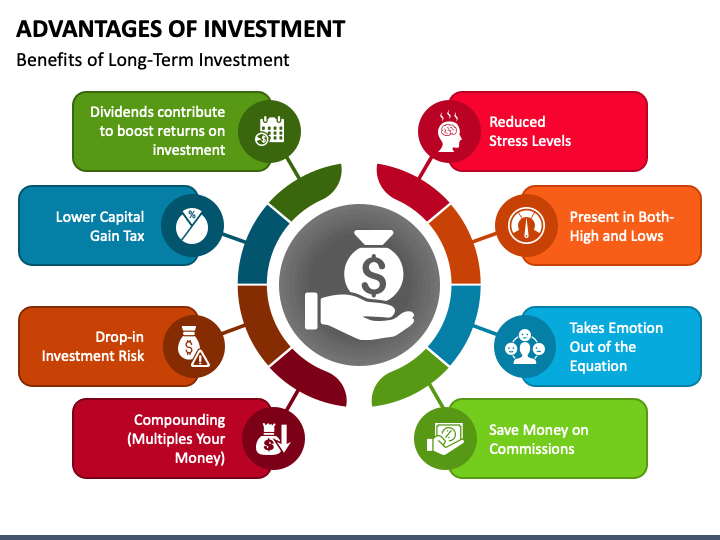

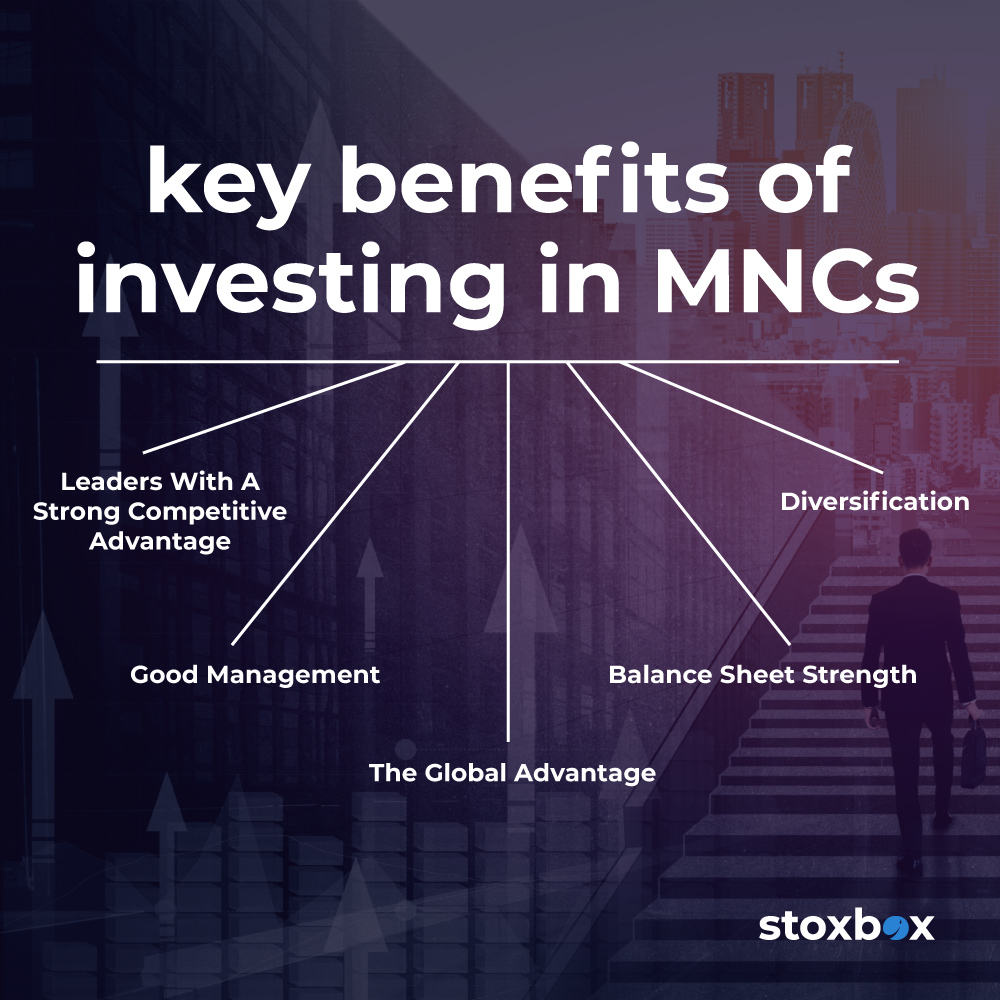

The firms we follow require a solid performance history usually a minimum of 10 years of running history. This implies that the business is likely to have actually faced at least one financial slump which monitoring has experience with difficulty in addition to success. We look for to leave out business that have a credit score quality listed below investment grade and weak nancial stamina.A firm's capacity to increase returns constantly can demonstrate protability. Companies that have excess cash money ow and strong nancial positions typically select to pay returns to bring in and award their investors.

All about Amur Capital Management Corporation

We have actually discovered these supplies are most in jeopardy of cutting their dividends. Expanding your investment portfolio can assist shield versus market uctuation. Look at the following variables as you plan to branch out: Your profile's property class mix is among the most important consider identifying efficiency. Check out the dimension of a business (or its market capitalization) and its geographical market U.S., industrialized global or emerging market.

Despite how very easy electronic financial investment monitoring platforms have made investing, it should not be something you do on a whim. If you determine to get in the investing globe, one thing to think about is exactly how long you really want to invest for, and whether you're prepared to be in it for the long haul - https://soundcloud.com/amurcapitalmc.

In fact, there's a phrase common associated with investing which goes something along the lines of: 'the ball might drop, but you'll intend to see to it you're there for the bounce'. Market volatility, when financial markets are going up and down, is a common phenomenon, and long-term could be something to aid smooth out market bumps.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Joe invests 10,000 and makes 5% returns on this investment. In year two, Joe makes a return of 525, because not only has he made a return on his initial 10,000, but additionally on the 500 invested reward he has actually gained in the previous year.

Getting My Amur Capital Management Corporation To Work

One means you can do this is by getting a Stocks and Shares ISA. With a Supplies and Shares ISA. exempt market dealer, you can spend approximately 20,000 annually in 2024/25 (though this undergoes alter in future years), and you don't pay tax obligation on any returns you make

Getting going with an ISA is really easy. With robo-investing systems, like Wealthify, the hard work is done for you and all you require to do is pick just how much to spend and pick the danger level that matches you. It might be among the few instances in life where a much less psychological approach could be valuable, yet when it concerns your financial resources, you may intend to listen to you head and not your heart.

Remaining concentrated on your long-term goals might help you to prevent illogical choices based on your feelings at the time of a market dip. The tax obligation therapy depends on your specific conditions and might be subject to transform in the future.

The Best Strategy To Use For Amur Capital Management Corporation

However investing goes one action additionally, aiding you accomplish personal objectives with 3 significant advantages. While conserving means setting apart component of today's cash for tomorrow, investing ways putting your money to work to potentially earn a far better return over the longer term - mortgage investment. https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1712311217&direction=prev&page=last#lastPostAnchor. Various classes of investment possessions cash, fixed rate of interest, home and shares usually generate various degrees of return (which is loved one to the danger of the More about the author investment)

As you can see 'Development' assets, such as shares and property, have traditionally had the most effective total returns of all possession classes however have likewise had bigger optimals and troughs. As a financier, there is the prospective to gain resources growth over the longer term as well as a continuous earnings return (like rewards from shares or rent from a building).

Amur Capital Management Corporation Things To Know Before You Get This

Rising cost of living is the continuous increase in the expense of living gradually, and it can effect on our monetary wellbeing. One way to assist surpass inflation - and produce favorable 'real' returns over the longer term - is by purchasing assets that are not simply with the ability of supplying greater revenue returns but also use the potential for capital development.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Batista Then & Now!

Batista Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!